Why It Matters

A data breach affects more than just your systems — it disrupts trust, operations, and financial security.

Customer Loss – Clients may leave permanently if you fail to protect their personal data.

Business Disruption – According to SecureWorks, downtime and lost productivity account for nearly 39% of total breach costs.

Regulatory Fines – Agencies like the FCC and FTC can impose hefty fines and enforce strict compliance measures.

Legal Action – Customers often sue when their personal or financial information is compromised.

Reputation Damage – Rebuilding your brand after a public breach often requires costly PR support.

Direct Financial Theft – Some breaches give attackers access to your financial accounts, allowing them to wire funds before you even realize it.

Why It Matters

A data breach affects more than just your systems — it disrupts trust, operations, and financial security.

Customer Loss – Clients may leave permanently if you fail to protect their personal data.

Business Disruption – According to SecureWorks, downtime and lost productivity account for nearly 39% of total breach costs.

Regulatory Fines – Agencies like the FCC and FTC can impose hefty fines and enforce strict compliance measures.

Legal Action – Customers often sue when their personal or financial information is compromised.

Reputation Damage – Rebuilding your brand after a public breach often requires costly PR support.

Direct Financial Theft – Some breaches give attackers access to your financial accounts, allowing them to wire funds before you even realize it.

Cyber Liability:

Your Safety Net in a Digital World

CyberStone’s policies help businesses of all sizes stay protected, recover faster, and meet today’s evolving cyber risks with confidence.

Cyber Liability:

Your Safety Net in a Digital World

CyberStone’s policies help businesses of all sizes stay protected, recover faster, and meet today’s evolving cyber risks with confidence.

What’s at Stake?

With Cyber Insurance

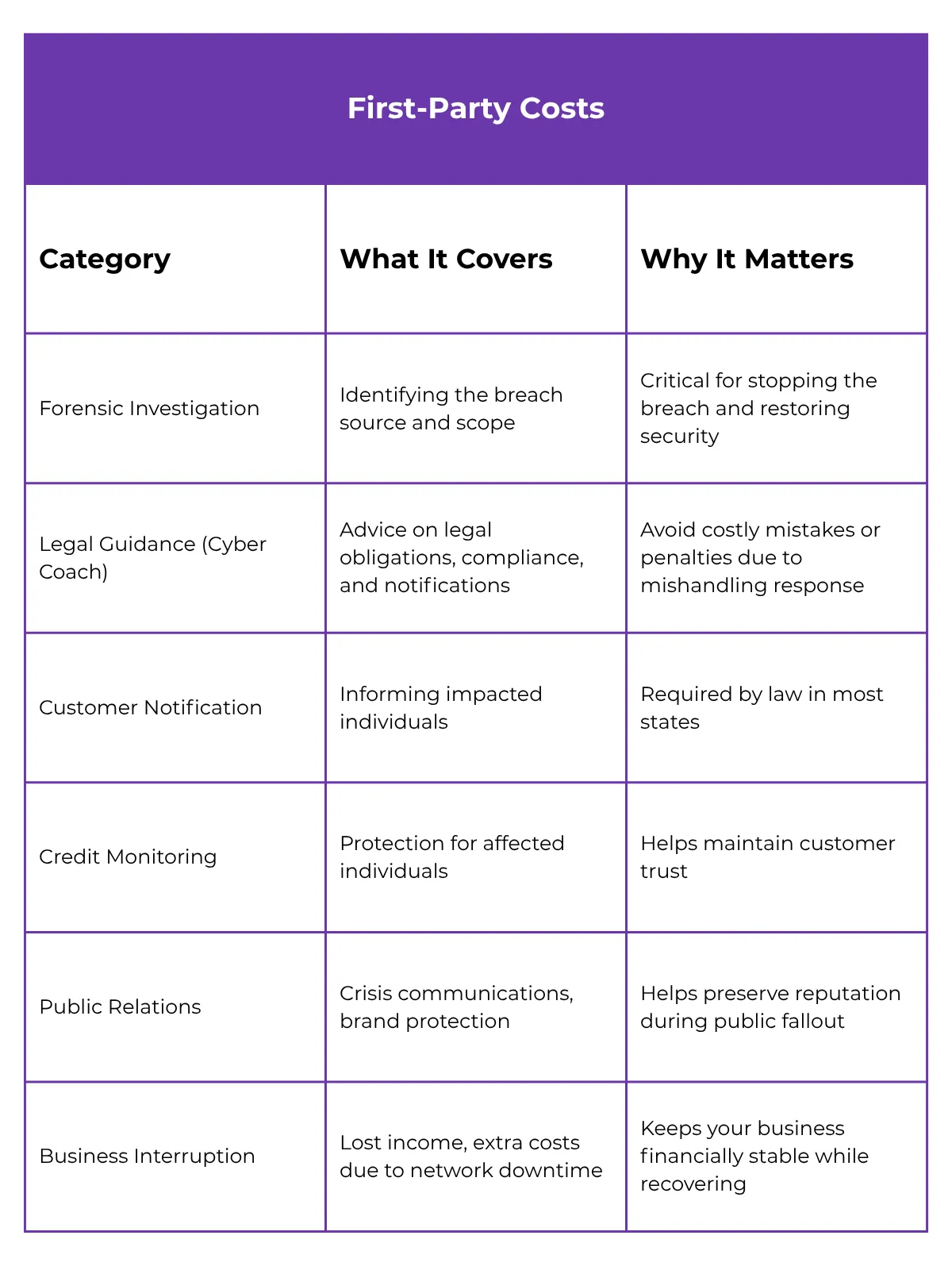

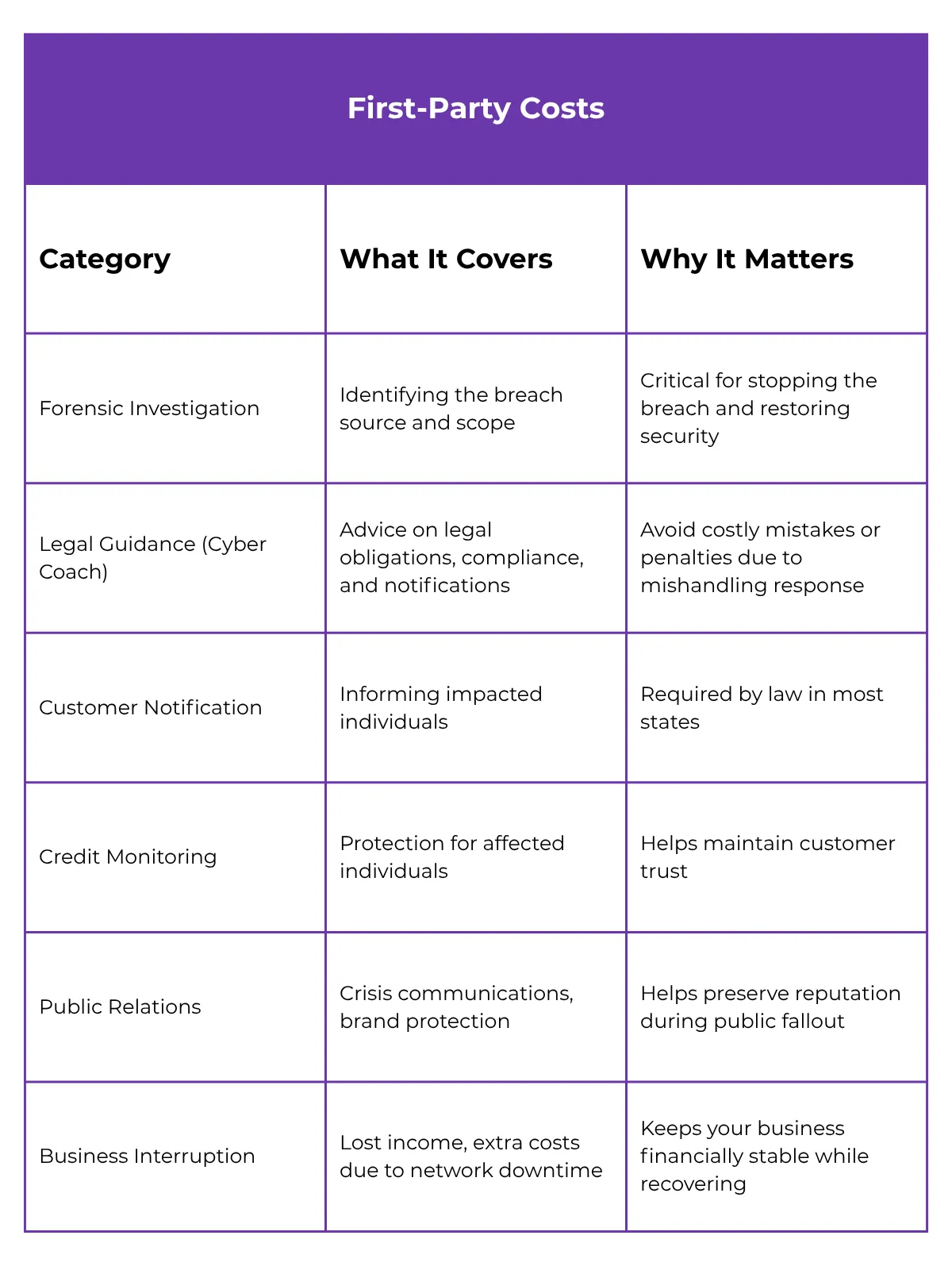

Immediate breach response with legal, IT, and PR support

Coverage for notification costs, credit monitoring, and forensic investigations

Business interruption protection — recovers lost income

Legal defense and settlements covered

Regulatory fines and PCI penalties insured (where allowed)

Reputational support from public relations professionals

Peace of mind — you’re protected by experts in cyber risk

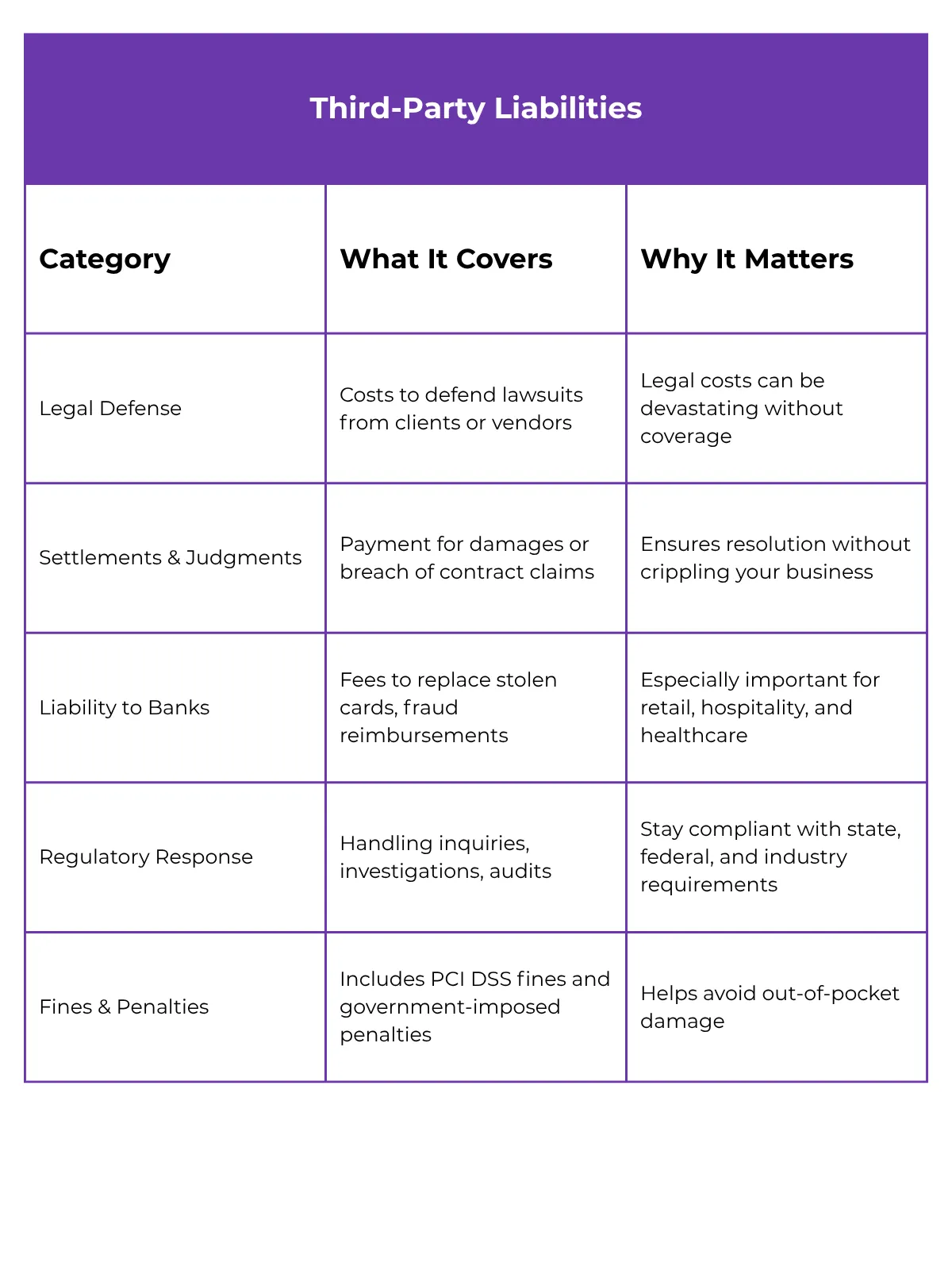

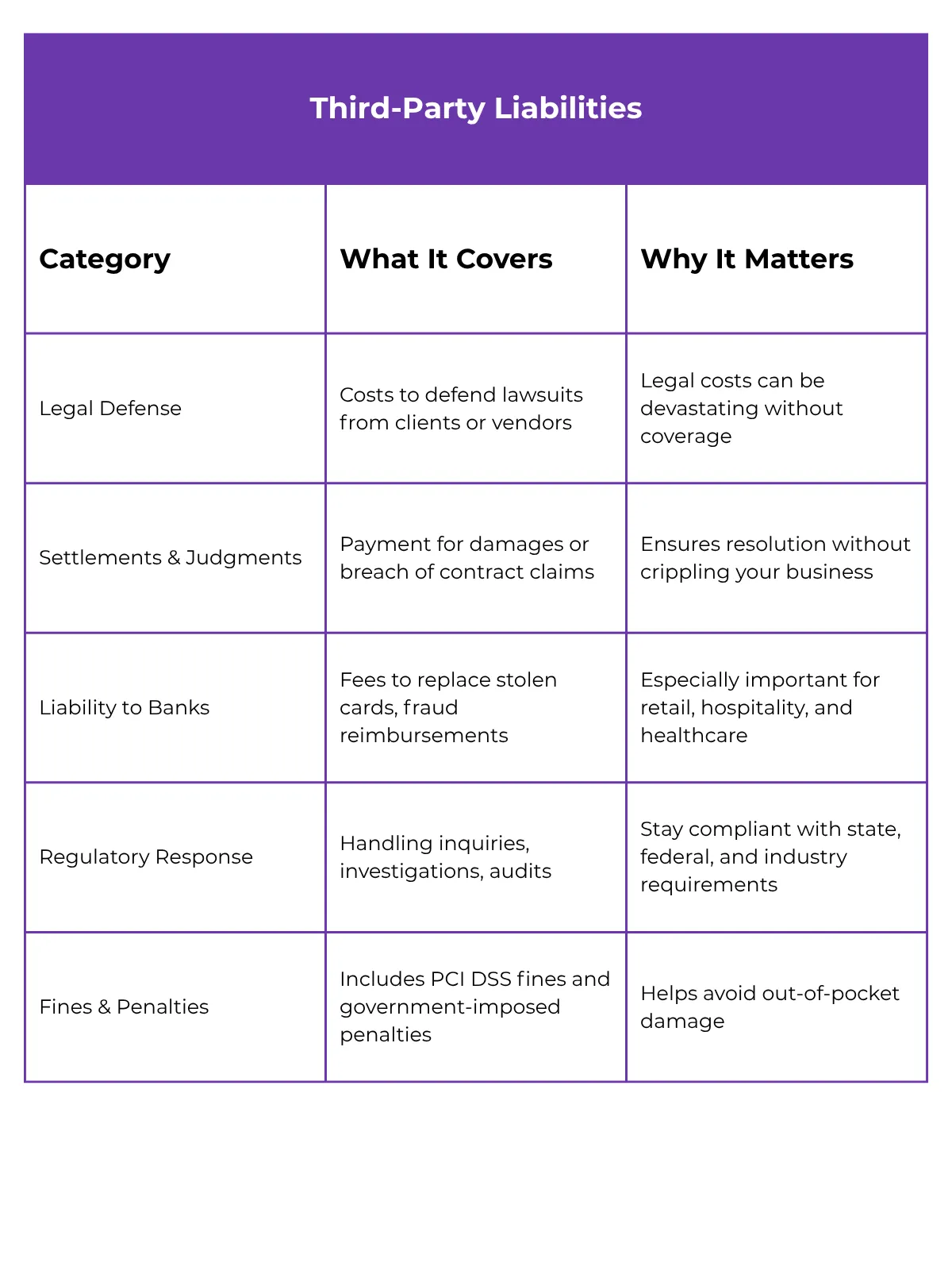

Without Cyber Insurance

Delays in breach containment, leading to greater damage

Must pay out-of-pocket for legal obligations, which can cost hundreds of thousands

Lost revenue during downtime with no financial backup

Exposed to lawsuits and massive legal bills from customers or partners

Risk of fines from the FTC, state AGs, HHS, PCI DSS, and more

No PR help — negative press can permanently damage your brand

Chaos, confusion, and financial instability during one of your worst business events

What’s at Stake?

With Cyber Insurance

Immediate breach response with legal, IT, and PR support

Coverage for notification costs, credit monitoring, and forensic investigations

Business interruption protection — recovers lost income

Legal defense and settlements covered

Regulatory fines and PCI penalties insured (where allowed)

Reputational support from public relations professionals

Peace of mind — you’re protected by experts in cyber risk

Without Cyber Insurance

Delays in breach containment, leading to greater damage

Must pay out-of-pocket for legal obligations, which can cost hundreds of thousands

Lost revenue during downtime with no financial backup

Exposed to lawsuits and massive legal bills from customers or partners

Risk of fines from the FTC, state AGs, HHS, PCI DSS, and more

No PR help — negative press can permanently damage your brand

Chaos, confusion, and financial instability during one of your worst business events

The Bottom Line:

A single cyber event can cost more than $250,000 — or even shut your business down.

Cyber insurance isn’t just protection. It’s survival.

The Bottom Line:

A single cyber event can cost more than $250,000 — or even shut your business down.

Cyber insurance isn’t just protection. It’s survival.

+1 845 762 4110

Learn

Cyber Insurance 101

Educational Downloads

+1 845 762 4110